FAQs

No, Mydoh is not a child savings account. Kids and teens do not receive interest or any other earnings on their Savings buckets or on money in their Mydoh Wallet.

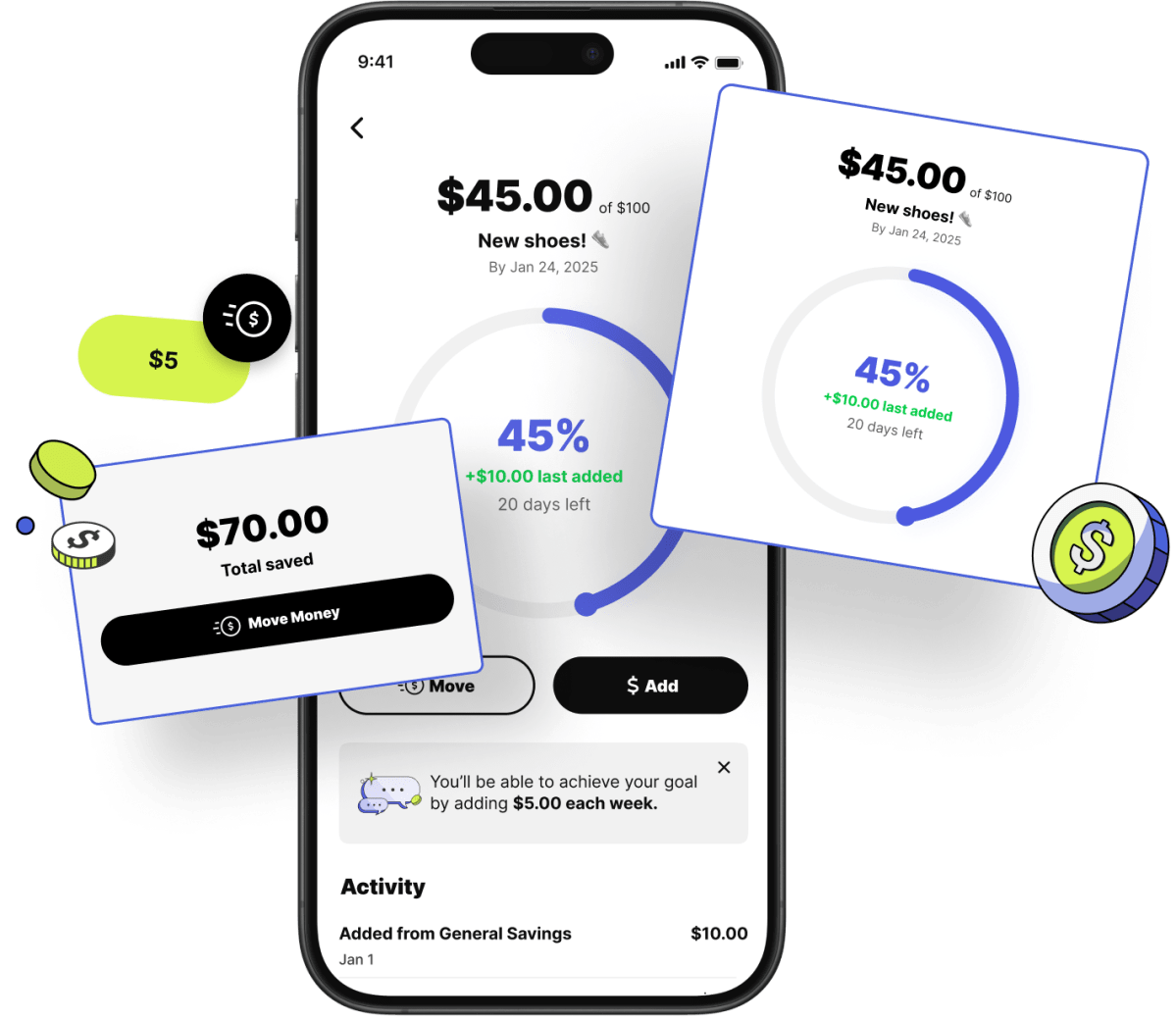

To know when your kid has achieved their Savings Goal, log into your Mydoh parent account and tap on your child’s name on the home screen. Then scroll down and select “Savings Goals.” From there, you will be able to see an “Achieved” tag on the top right hand side of the screen, which means your kid has reached their savings goal.

Yes, Mydoh offers a free savings calculator for kids, even if they’re not a Mydoh customer. Our savings goal calculator takes into account your kids’ income and spending to show them how long it will take to reach their savings goals. They’ll receive a personalized savings plan to show them how long it’ll take to save up for what they want.

If your kids don’t have a specific goal to save for, but still want to put money away for a rainy day, then they can use the General Savings feature. General Savings is a great tool to help kids and teens develop the habit of saving money regularly. The money won’t be available to spend, until kids move it from General Savings into their wallet.

Parents can encourage their kids to save money by encouraging them to set a savings goal, giving them an opportunity to make money through chores and allowance, and give them a place to save money—like in Mydoh’s Savings Goal feature.

Everyone, even teens, should have money saved for an emergency fund. Saving for an emergency fund means they’ll have funds available to cover the cost if something goes wrong, without having to go into debt. It’s a valuable skill to learn now when your teens’ idea of an emergency is a cracked smartphone screen and not paying to replace a roof.

Parents and caregivers can help teach their kids to create a budget by having them calculate their income (like a part-time job or allowance), decide how much they want to save, then calculate their expenses (like buying a new game or going for takeout with friends). Our savings calculator will take kids and teens through these steps.