Money can sometimes be a source of stress and self-doubt for many of us. And families are already feeling stressed from rising costs due to inflation and an uncertain economic future. That’s why Mydoh wanted to take a pulse check on how Canadian parents feel about money and what they hope to teach their kids about financial literacy.

Curious to know how parents really feel about money? Mydoh commissioned Ledger to conduct an online survey of 1,500 parents of kids aged 6-18 across Canada, except for Quebec. Here’s what they had to say.

2022 financial literacy survey key findings

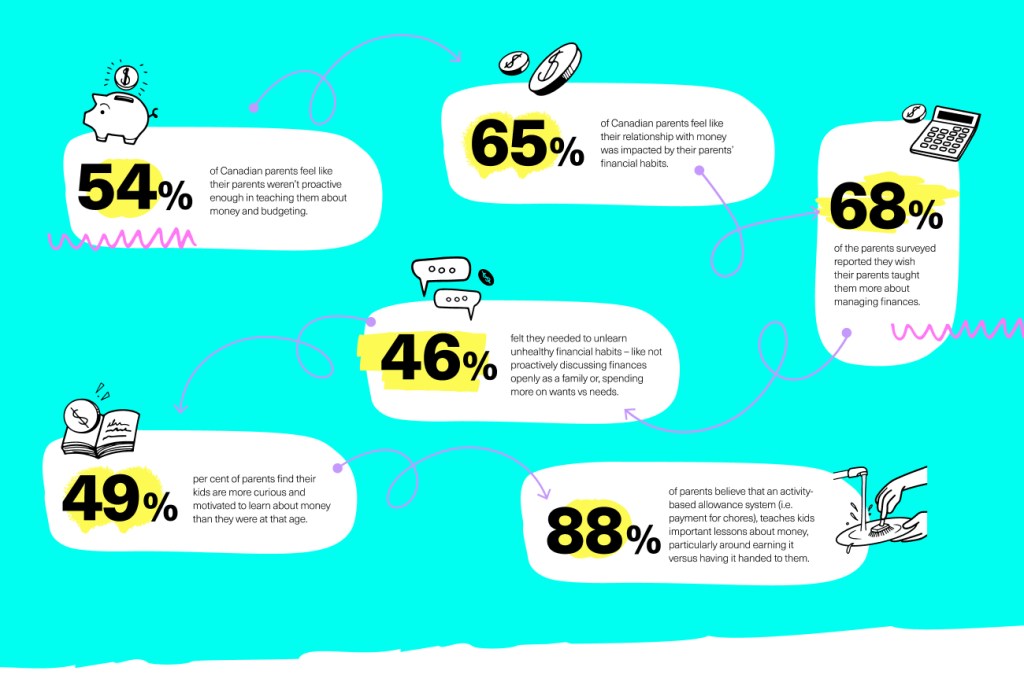

- 54% of Canadian parents felt like their parents weren’t proactive enough in teaching them about money and budgeting

- 46% of parents felt they had to unlearn unhealthy financial habits

- 68% of parents wished their own parents had taught them more about managing finances

- 49% of parents find their kids are more curious and motivated to learn about money than they were at that age

- 88% of parents believe that paying for chores teaches kids important lessons about money, particularly around earning it.

Mydoh financial literacy survey results

“Money carries a lot of stress for Canadians—women and people of colour particularly—and from the survey, we’re seeing that stressors can be passed down through the generations, sometimes unintentionally,” said Sammer Haq, who is Head of Data and Analytics at Mydoh, and Founder and Executive Director at BridgeTO Youth.

Here are some specific findings from the survey and how parents can give their kids the tools they need to learn real-world money skills:

Parents could be more proactive teaching money management

We learn a lot from our parents: how to ride a bike, how to tie our shoelaces, and how to share with others (even when we don’t want to). Another thing kids learn from their parents is how to manage their money. Mydoh’s survey revealed that more than one in two parents felt like their parents weren’t proactive enough in teaching them about money management. Further, parents who identified as a person of colour felt these gaps in financial literacy to a greater degree.

How parents can give their kids a head start on money management

While your parents may not have taught you the budgeting and money skills you wished they had, there’s still time for you to ensure the next generation is equipped to learn about personal finance and apply those skills in their own lives.

Parents can start by introducing money basics, including the concept of financial literacy. But let’s face it, teaching kids about something like financial literacy can be intimidating. Start by tackling these five key components of financial literacy:

1. Earning money

Kids and teens will more easily grasp the idea of money when it’s up to them to earn their own. Getting an allowance or a first part-time job helps kids and teens develop an understanding of the value associated with money and what it takes to earn it.

2. Spending cash

Kick-start your kid’s financial education by helping them create a personal budget, which helps give them control over how they spend their money and track their expenses.

3. Saving and investing

Teens can grasp the importance of saving money and planning for short- and long-term goals. While most investment products require you to be the age of majority, kids and teens can boost their financial literacy by opening a free practice investment portfolio to help them learn about income growth.

4. Borrowing money

Help your kids stay out of a bad debt cycle by teaching them about borrowing before they get their first credit card.

5. Protecting themselves

It’s true that most kids are more tech-savvy than their parents, but teens may not yet have the experience to deal with identity theft or online scams. Talk to your kids about online privacy and security, and why it’s important to not share personal information with others online.

Read more about 8 reasons to teach kids financial literacy to kids & teens.

Parents need to unlearn their unhealthy financial habits

Another area where generational influences have impacted Canadians is in relation to financial habits, with 46 per cent of parents saying they felt they needed to unlearn their unhealthy financial habits—like not having a budget, not saving a set amount each month, or going into debt.

How parents can teach and learn better financial habits

Building good habits takes time and energy (James Clear has written an entire book about habits, and shares some tips here about creating good habits). So breaking the cycle of unhealthy habits won’t necessarily happen overnight. But as parents make changes to their money habits they can also teach their kids healthier ways of managing their money. Here are a few places to start:

1. Wants vs. needs

Understanding wants vs. needs means that kids and teens can assess whether their spending choices are must-haves or nice-to-haves and be better positioned to avoid debt.

2. Learning to budget

Like other skills, getting smart with money and learning about budgets and expenses takes practice, and practice takes time. One simple way to do this is use the 50/30/20 budgeting rule. That means kids put aside 50 per cent of their income (or allowance) towards needs, 30 per cent towards wants, and save 20 per cent.

Read more: What is a zero-based budget? A guide for parents and teens.

3. Paying off debt

Being in debt often teaches your teen how ignoring a problem will only make it worse. If your teen finds themselves in debt, there are two common strategies to pay it off. The first is the “debt avalanche” method where they focus on paying off the highest interest debts first. The “debt snowball” method works by tackling the smallest debts first and having that momentum carry them forward to pay down more.

Read more: How to pay off debt fast.

Money should be openly talked about as a family

Some bright news from the survey was that 70 per cent of parents believe that money should be openly talked about as a family. And almost half of the parents we surveyed found their kids were more curious and motivated to learn about money than they were at the same age.

How parents can motivate their kids to learn about money

Here are some ways parents can help motivate their kids to learn about money—from making it to saving it:

1. Gamify your savings

Gamification is one way kids and teens can begin to save money without it feeling like a chore. Setting up a savings ladder and checking off the rungs along the way, creating an envelope challenge, or some friendly competition to meet your savings goal faster are just a few ways teens can gamify their savings.

2. Encourage kids and teens to start their own business

Some kids and teens are natural entrepreneurs. So if your teen has a brilliant business idea to start baking cakes, become a dog walker, or sell vintage clothing online, encourage them to explore their passions and earn their own money.

Read more: How to make money as a kid online.

3. Understand how interest works

While understanding interest is important when it comes to investing, it’s just as—if not more—important for teens to understand how interest works when borrowing money. Chances are high that in your kids’ lives they will take out a car loan, apply for a credit card, or even take on a mortgage. That’s why they should learn the difference between APR and amortization, or how much that personal loan is really going to cost them in interest.

Chores and allowance can teach kids valuable lessons about money

Our survey showed that most parents agree: allowance-based activities, like chores, teach kids important lessons about money. They know that talking about money isn’t enough; you’ve to walk the walk. And assigning chores and providing an allowance is usually a kids’ first taste of work. While paying kids household chores isn’t new, having a digital tool like Mydoh can be a great help in getting kids and teens to be proactive about their household responsibilities.

How parents can think of chores the right way

Here are some other things parents might want to consider:

1. What type of allowance should you give?

Earning an allowance is a rite of passage for many kids. But not all allowances are the same. Should you pay your kids and teens a pure allowance (aka no strings attached), a chore-based allowance, or a hybrid of the two?

2. Chores help teach life skills

While getting help with unloading the dishwasher is reward enough for assigning chores, there are also some beneficial life skills that they’ll learn in the process. Soft skills like time management, problem solving (how do you operate a washing machine?!), and work ethic could help them when they join the workforce. While cooking and home maintenance are invaluable when they’re living on their own.

3. Kids with disabilities benefit from chores too

Not every kid has the same abilities. But parents can support their kids and teens who do have a disability in successfully taking on household chores. Sometimes, special consideration should be taken when adding chores to the daily or weekly routine of children with disabilities. Consider factors such as breaking down each step of the process, being consistent and generous with your praise, and finding what motivates your child.

Want to learn more? Download our free eBook Parents’ Guide to Getting Your Kids to Do Chores.

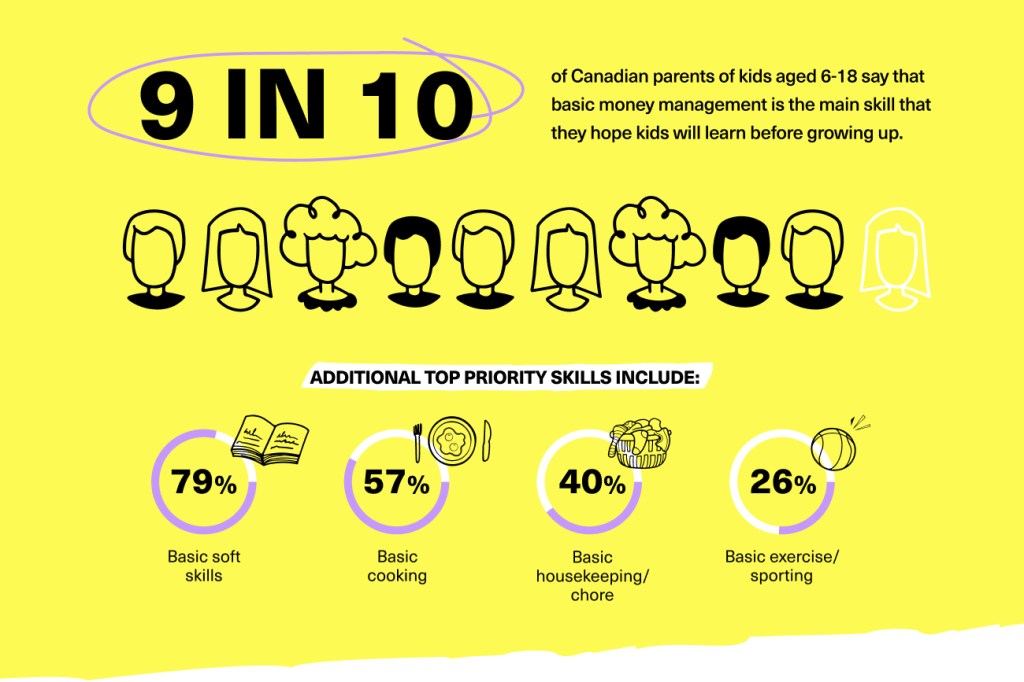

Basic money management is a main skill parents want their kids to learn

Our survey found that 90 per cent of Canadian parents surveyed rank basic money management as the main skill they hope their kids will learn. Clearly, raising money-smart kids and teens is important to Canadian parents.

How parents can teach their kids money management

“Whether it’s active learning, or having candid discussions in a grocery store, the goal for parents needs to be breaking the cycle,” says Angelique de Montbrun, who is Chief Marketing Officer at Mydoh and a parent of three. “Parents can do this by proactively planning, as a family, to build these healthy habits together.”

Start with one conversation at a time.

Download the Mydoh app to help your kids and teens build confidence to manage their money and grow to become financially independent.

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or its affiliates.