Are you noticing your budget doesn’t cover quite as much as it used to? From groceries to used cars, rising prices are evident just about everywhere we shop. With inflation in Canada the highest it’s been in more than three decades, it’s no surprise this is the new buzz word—across headlines and households.

As parents, you may be adjusting the family budget, finding ways to save money on groceries, and teaching your kids how to save money. You may also find you’re saying no more frequently to your kids’ requests for new things, so why not take this opportunity to explain inflation to your kids and teens? Understanding inflation will expand your kids’ money smarts and provide context for today’s rising prices and the challenges they present.

In this article, we offer an explanation of inflation, how it’s measured, the causes and effects of inflation, and its potential impact on Canadian families. Here’s how to explain inflation to a child.

What is inflation?

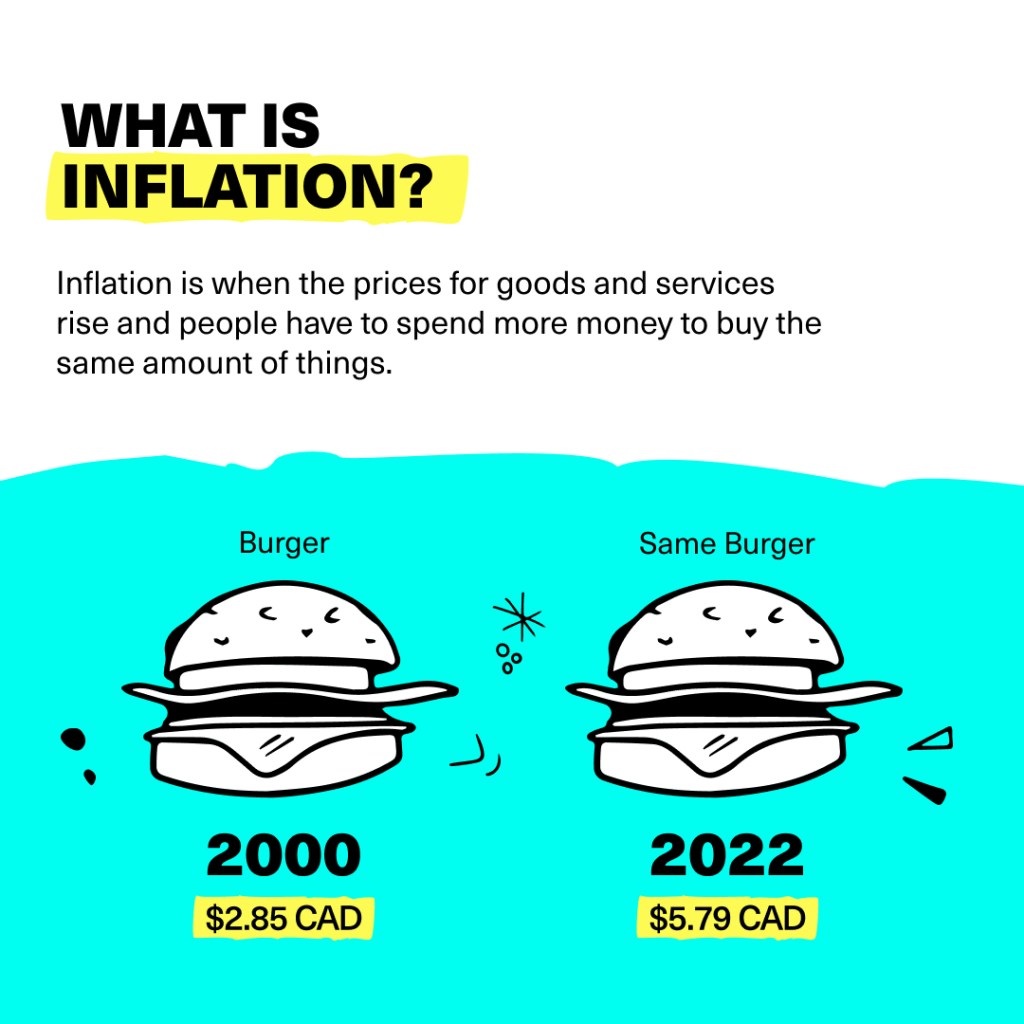

Inflation is when the prices for goods and services rise, and purchasing power goes down. Simply put, everything becomes more expensive and people have to spend more money to buy the same amount of goods and services.

Consider that a Big Mac cost $2.85 CAD in 2000, yet today it costs about $5.79— that’s more than double in a little over two decades. Your kid could have bought two burgers then, for the amount they pay for one burger now.

Is inflation good or bad?

It makes sense to think inflation is bad. It lowers the purchasing power of our money and makes it tougher to buy the things we want and need with our earnings. However, inflation can be good, as well. A stable low rate of inflation encourages spending, investing, and growth in the economy.

Is there a “good” inflation rate?

Believe it, or not, there is an ideal inflation rate in Canada. The Bank of Canada (BoC) has calculated that rate to be two per cent. The BoC’s strategy to maintain this rate is called inflation targeting. It was introduced in 1991 as a way to manage high inflation in the 1970s and ‘80s, and continues today.

Based on the ideal inflation rate, you can expect prices in Canada to increase by about two per cent every year. If a pair of sneakers cost $100 CAD this year, and inflation is two per cent, the same pair of sneakers will cost $102 next year.

When inflation is steady and predictable, it’s easier to budget. You know with relative certainty that prices won’t change drastically and your purchasing power will not unexpectedly drop.

If your kids are saving up for a special item, ask them to predict its cost a year from now based on a two per cent inflation rate. How about at five per cent? If they knew the price would go up even more, how would they react? Would they buy it sooner if they could? These are some of the issues families deal with when inflation rises faster than expected, such as what’s happening now with the inflation rate around 5.7 per cent.

What is hyperinflation?

Inflation increasing at a rapid out-of-control pace is called hyperinflation. Although rare, hyperinflation has occurred throughout history. The worst case was in 1946 Hungary when the daily inflation rate was 195 per cent and prices doubled almost every 16 hours!

If that were to happen today, it would mean an ice cream cone that costs two dollars today, would cost four dollars tomorrow, and eight dollars the day after that. Luckily for Canadians, hyperinflation is not likely to occur. In fact, the highest rate of inflation ever recorded in Canada was over a century ago when prices climbed 19 per cent in a single year in 1917.

What is stagflation?

What happens when you combine a stagnant economy and inflation? You get stagflation. This means even though people are earning less money (due to a stagnant, slow-growing economy), they’re paying more for everything from soda to sneakers.

Typically, prices don’t increase when incomes go down since the demand for goods also tends to decline, which makes stagflation a bit unusual and hard to address. However stagflation can occur, as it did in the 1970s, impacting many countries including Canada.

What is deflation?

With all this talk about rising prices, did you know prices can also decline? This is called deflation. Although it may sound like a good thing, a major decrease in prices can be harmful to the economy. As prices drop, profits decrease which can lead to lower incomes and fewer jobs. Although rare, it happened in Canada during the Great Depression when prices fell 25 per cent from 1930 to 1933.

Learn more: The parents’ guide to talking to kids about a recession.

How Canada measures inflation

The Bank of Canada wants to prevent sudden rises in inflation. To do this, it keeps a close eye on the price of goods and services that Canadians buy with what’s called the Consumer Price Index (CPI). The CPI is based on a virtual basket filled with hundreds of goods and services that Canadians buy. Every month, the CPI adds up the total cost of the basket’s contents and tracks the month-to-month change in prices. The percentage change in the CPI is a measure of inflation.

If your family spent $100 CAD on pizza delivery, books, and sweatpants one month and, a year later, spent $110 on the same goods, the inflation rate would equal 10 per cent. Your kids can check out the Bank of Canada inflation calculator to calculate how much the value of a dollar has changed over time from as far back as 1914!

Because what Canadians bought ten, twenty, or thirty years ago isn’t the same as what Canadians buy today, the basket is reviewed annually to reflect purchasing habits. It recently added gaming consoles, food and restaurant delivery charges, and hand sanitizer to the basket.

What causes inflation?

While there are many causes of inflation, they can generally be divided into two main categories: demand-pull inflation and cost-push inflation.

Cost-push inflation

When costs rise from cost-push inflation, it’s driven by the supply side. The price of goods increases because they cost more to produce. There are various reasons why this could happen, such as a rise in the cost of raw materials, higher labour costs, or unforeseen circumstances that disrupt production, such as a flood or a pandemic, like COVID-19.

Production of many goods slowed during the pandemic because of delays in transportation, as well as labour shortages due to people getting sick from COVID-19. These are both examples of cost-push inflation because a shortage in goods drives prices up. At one point, there was even a chicken wing shortage that drove the price of wings up by 14 per cent.

Demand-pull inflation

When prices increase because of demand-pull inflation, it’s driven by consumers. Simply put, people are buying more stuff. Often this is because the economy is healthy, incomes are rising, and we can afford more things—take out dinners, trendy clothes, the latest smartphone. With people demanding more and more of the same stuff, the supply can’t keep up and prices rise.

During COVID-19, demand for goods and services increased as lockdowns eased and people wanted to pay for more things, like eating out or travelling, that they couldn’t enjoy during the height of the pandemic. These are examples of demand-pull inflation.

What are the effects of high inflation?

When the inflation rate rises a lot higher than expected, it impacts households in various ways. Here are some of the ways inflation may be affecting your household that you can share with your kids:

Stuff is more expensive

When your income stays the same as prices rise, it’s like you’re being paid less. Your usual expenses are less affordable, so even simple trips to the grocery store will cost more for the same products. Your kids may have noticed the prices of some of their favourite items have gone up—from purses to smart watches to potato chips. (Your kids may soon be asking for a higher allowance amount).

Spending habits change

If you have the same amount of money coming in, but your costs are going up, it makes sense to adjust spending habits. Some of the ways people cut costs include:

- Switching to lower priced brands

- Going out for dinner less often

- Shopping at discount grocery stores

- Postponing big purchases

Harder to budget

Creating and sticking to a budget can be harder when inflation rises faster than expected. If your teen is saving for college or university, the goal is based on an expectation of what the cost will be when they graduate high school. But what happens if tuition rises higher than expected in that time frame? Your kid may have to rethink how much money to save.

Read more about budgeting for kids and teens

Conserve more

With a tighter budget, it becomes more important to save money by conserving. Your family may work harder to limit waste in food, energy, or fuel. The good news is these efforts can also benefit the environment, which may help motivate your kids to eat leftovers or to turn off the lights before leaving a room.

Read more: 10 tips to thrift like a pro.

Higher interest rates

One of the ways the Bank of Canada tries to bring inflation back down to two per cent is by raising interest rates. Here are a couple ways this can impact families:

Paying down debt may be more challenging

Higher interest rates may make it harder for families to pay down their debts, especially if they have mortgages or loans that suddenly require higher monthly payments than they’ve budgeted. Conversely, you’re less likely to take on additional debt as interest rates rise because it’ll take you longer to pay that debt off.

Learn more How to pay off debt fast: A guide for parents and teens.

Saving money is more attractive

Interest rates increase for savings deposits, as well. This can encourage you to save money, rather than spend it.

Why do kids and teens need to understand inflation?

Learning about inflation can help prepare kids for making financial decisions as they enter adulthood, particularly when it’s time to make large purchases such as a car or a home. When starting a new job, they will be more likely to negotiate increases in pay to cover potential cost of living increases.

Teens and tweens who understand inflation can better comprehend the reasons behind their own family’s changes in household spending. Perhaps they’ll even be more cooperative in those efforts.

Raise money smart kids to help them stay ahead of inflation

Teaching your kids the basics of inflation can help them make sense of why their family’s savings goals and spending habits need to adjust, at times. Learning these money smart lessons will also better prepare them to confidently navigate economic challenges as they enter adulthood and reach financial independence.

The Mydoh app and Smart Cash Card provide children with the opportunity to save and earn money with a digital wallet. As a parent, you’ll be able to assign chores and allowance, and also use our oversight feature to coach, guide, or just keep an eye on your child’s spending habits.

Download the Mydoh money app today and give your kids the tools they need to navigate the world of inflation and personal finance!

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or its affiliates.