15 Financial Terms You and Your Teen Should Know

Boujie broke… cozzi livs… vibecession. Keep the money conversation going by learning these 15 financial buzzwords.

Guide to 2025 Tax Deductions for Families

Unsure of which tax deductions your family can claim when you file your taxes with the CRA? Here are 8 tax credits you should know about.

What Kids and Teens Need to Know About Financial Scams

Learning how to spot a financial scam and how to protect yourself is one way kids and teens can protect themselves and their money!

What Teens Need to Know About Economic Inequality in Canada

Rich or poor—and in-between—economic inequality affects all of us. Here are the essential facts about inequality and what we can do about it.

The Newcomer Parents’ Guide to Banking in Canada

If you’re a newcomer to Canada, here’s a guide to help you understand seven common banking products for families.

What Teens Need to Know About Loud Budgeting

The money-saving trend that’s taking over TikTok might help you hit your financial goals.

What Teens Need to Know About Filing a Tax Return in 2024

If your teen earns money through a part-time job, there are benefits to filing a return. Here’s what teens need to know about how to file a tax return in Canada.

Financial Literacy Month Toolkit

November is Financial Literacy Month. We’re sharing articles and tips to empower teens to invest in their financial wellbeing.

How to Build a Credit Score in Canada: A Guide for Teens

What do landing your dream job, buying a new car, or renting an apartment have in common? You’ll probably need a credit score for all three.

How to Spend Money According to Your Values: A Guide for Parents and Teens

Here’s what teens and kids need to know about value-based spending and how to spend their money on what matters most to them.

How to Help Teens with ADHD Manage Their Money

Help kids and teens with ADHD or ADD develop money skills. We share 8 tips to help them with impulsivity, improve decision-making and financial literacy.

Financial Issues that Impact 2SLGBTIQ+ Teens

Did you know it could cost more to be queer? Here are six financial issues that 2SLGBTIQ+ teens should be aware of.

Introducing Mydoh By Me

Introducing Mydoh by Me—Canada’s first custom card for kids and teens!

What is a Zero-Based Budget? A Guide for Parents and Teens

Are you looking for a way to show your teens how to manage their money? Learn how a zero-based budget (ZBB) can benefit your family.

Best Personal Finance Podcasts for Parents

Whether you’re money savvy or trying to find your financial footing, relatable financial information has never been as accessible as it is right now. Here’s 10 of the best finance podcasts for parents.

The Parents’ Guide to Teaching Kids About a Recession

As inflation rises, people are wondering if Canada is headed towards a recession. Explain to your kids what causes a recession and how it might impact your family.

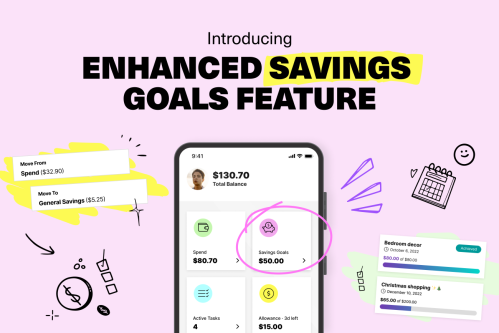

Introducing Enhanced Savings Goals Feature

Saving for what you want just got easier with Mydoh’s enhanced savings goals feature. Learn how your kids can put money aside and save for up to three goals.

10 Common Money Mistakes Parents Make and How to Avoid Them

Juggling the responsibilities of kids and work doesn’t always leave parents much time (or energy) for financial planning. But avoiding these common money mistakes will help point the family budget in the right direction.

What is Financial Health and Why is it Important?

Did you know that money problems are the top source of stress for Canadians? Breathe easier by improving your financial health.

10 Top Financial Influencers Teens Should Follow

Financial influencers, also known as finfluencers, help make personal finance way less boring. Here’s some of the top finfluencers you should follow.

10 Money Mistakes Teens Make and How to Avoid Them

Good money habits start when they’re young. So do not-so-good ones. Here’s how you can help your teens and kids avoid common money mistakes.

Financial Literacy Survey: How Canadian Parents Feel About Money

Curious to know how parents really feel about money? Mydoh conducted a survey of parents across Canada to find out. Here’s what they had to say.

10 Best Finance Books to Teach Kids and Teens About Money

Give your kids and teens a financial foundation with 10 of the best books about money, savings, and investing.

Co-parenting Tips to Help Manage Finances

As co-parents, sharing the financial responsibilities of kids continues after separation or divorce. Here we outline how to manage your kids’ expenses together.

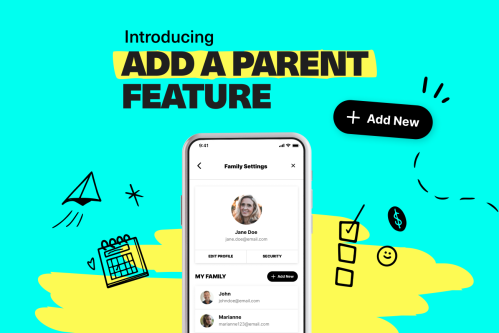

Introducing Add a Parent Feature

Now you can add a second parent to your Mydoh account at no extra cost, with just a few clicks, right in the app.

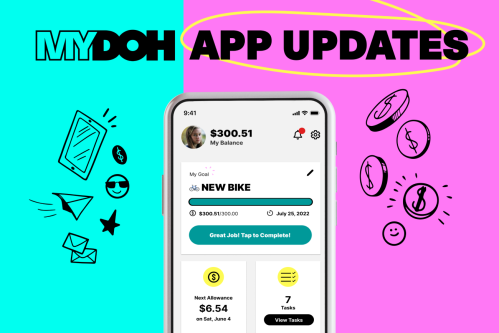

Introducing the Mydoh Goals App Feature

Mydoh Goals helps make raising money-smart kids easier. Learn more about our new app feature and how it can help kids and teens save for what they really want!

The Parent’s Guide to Teaching Kids About Inflation

Explaining inflation to kids doesn’t have to be complicated. Teach your kids how and why prices rise with inflation and its potential impacts with this guide.

Buy Now Pay Later (BNPL): Guide for Parents & Teens

Buy Now Pay Later (BNPL) plans may be helping Canadians get goods faster, but it’s helpful to know the full picture before deciding if BNPL is right for your household.

How to Open Your Kids’ First Bank Account

Graduating from a piggy bank to their first bank account is a big step in helping kids manage their money. Discover which bank account is right for your child.

What Parents Need to Know About Debit Cards for Kids

Too old for piggy banks, but too young for credit cards? We explain the benefits of using debit cards to teach your kids about money.

How to Explain What a Credit Card is to Your Kids

We share some tips on your teen’s first credit card including, how to use it responsibly, and why the Mydoh Smart Cash Card is a great alternative to credit for kids.

7 Tips to Teach Your Kids How to Use Credit Cards

When it comes to credit cards, it’s easy for kids to think of them as “free money.” Don’t wait, have “the talk” with them today and get the info you need to teach your kids about credit cards while they’re still young.