The new school year often feels like a new beginning. Time for a fresh start and to implement a new schedule and routines. As kids return to the classroom, parents should consider getting them involved in helping around the home with chores they’ll actually enjoy while also teaching them the value of earning their own money. The best place to start is with educating your kids on financial literacy and the importance of understanding how money works at an early age.

What is financial literacy and why is it important?

Financial literacy is a pretty big concept for the kids to grasp, but essentially it means teaching your kid about money and how to manage it responsibly. After all, it’s a skill that will help kids throughout their life. It can be as simple as introducing the concept of wants vs. needs, the value of saving for a long-term goal, and the pros or cons of paying with cash or debit versus a credit card. Encourage teenagers to save for their education and be transparent with your household budget, so they understand the real-world costs of living independently.

To learn more about financial literacy, check out our parents’ guide to financial literacy for teens and common financial literacy terms for kids.

How having responsibilities benefit kids (really!)

Research shows there are real benefits for kids as young as three-years-old who take on chores and tasks at home. These include higher self-esteem, better able to deal with frustration and delayed gratification. Helping out when they’re young leads to long-term success at school, work and relationships with others.

Encouraging kids to complete tasks at the same time each day (such as making their bed in the morning or clearing up after dinner) helps to create structure in their day and develop responsibility. Aside from becoming acquainted with how a washing machine works or that bathrooms don’t clean themselves, household tasks also provide kids with a sense of meaning in the family; that they’re part of a team.

13 chores kids can do to earn money

Making chores sound fun might seem like a stretch. But you can add a little play to household work. Giving kids set chores throughout the day helps them to establish a daily routine. And breaking up chores into smaller tasks is less overwhelming for kids – as anyone who ever sat aside a full day for housework will know! While we’re not suggesting your child does every chore on the list, here are some tasks they can complete throughout the day.

Before school chores

1. Making the bed

Start the day off with making the bed. Even younger kids can do this by straightening pillows and pulling the covers up. Ask them to choose a special stuffed toy (or ten) that sits on top of their made bed every morning. Give older kids a say in choosing a cool duvet cover or sparkly pillow, so they’ll have a bed they want to lie in.

2. Getting ready for school on their own

Give kids the responsibility of getting themselves ready in the morning. Have them choose their clothes and dress themselves, brush their hair and teeth, as well as tidy up in the bathroom after themselves.

3. Putting clothes in the laundry

Task kids with putting their clothes in the laundry basket. There are plenty of fun laundry hampers on the market that makes putting dirty socks away more of a slam dunk!

Lunchtime chores

4. Making their own lunch

If your child is learning remotely, they can be responsible for making their own lunch. Filling a bento box with delicious snacks is one way to make it more fun. Encourage kids to be creative with making wraps, fruit kabobs, cut softer foods like cucumbers or bread into shapes with cute cookie cutters or make their own trail mix.

5. Checking the mailbox

One of the most common chores is to check the mail. Parents can also teach their children about what kinds of letters and packages typically come in the mail, which will help them know what to expect when checking for them each day.

6. Taking the dog for a walk

A parent can easily teach their child to take care of a dog as a chore. Teaching them how to take care of the dog will also teach them responsibility, which is important in the development of any child. It’s also an excellent opportunity for your child to be active and explore their surroundings.

After school chores

7. Helping with dinner

Enlist younger kids in helping with dinner by washing vegetables, mash the potatoes, or set the table. Provide them with their own apron and plastic utensils. Older kids can take on more responsibility for the evening meal. Task them with making the salad or a side dish, helping to chop vegetables, as well as to measure and mix ingredients. As their skills develop, let them plan and prepare dinner once a week.

Read more: Tips for saving money on family dinner.

8. Sweeping the floors

Equip younger children with their own kid-sized broom and pan and challenge them to sweep up around the dinner table or kitchen.

9. Tidying up before bed

Before bedtime, do a 10-minute tidy. Set a timer for ten minutes, put on some upbeat music and set about clearing away the day’s clutter.

Weekend chores

10. Making breakfast for the family

With more time on your hands, have older kids make breakfast for the family, like blueberry pancakes or French toast with fruit. Siblings can get involved by setting the table as if they’re at a restaurant. Have them serve the rest of the family and clear up afterwards.

11. Washing the car

What could be more fun than a big bucket of soapy water and a garden hose? Have your child help wash, rinse off and polish the car.

12. Mowing the lawn

Your kid might be too young to drive, but there’s another motor they can get behind—the lawnmower. If your child is old enough, give them responsibility for cutting the grass. Younger kids can help in the garden too by raking leaves (see how big a pile they can build) or watering plants with their own watering can.

13. Helping with paying bills

Give your teens a lesson in financial literacy and show them how to pay bills then give them the responsibility of paying household bills online.

Looking for more fun chores for kids? Read 7 winter chore ideas, top spring chores and the most popular summer chores.

Use the Mydoh app to track chores and allowances

One of the best ways kids can learn financial literacy is to put their knowledge into practice by earning their own money. Mydoh is a money management app for parents and kids as young as 8-years-old. Kids receive a digital Smart Cash Card, which you’ll have access to and can see their spending activities and encourage good choices.

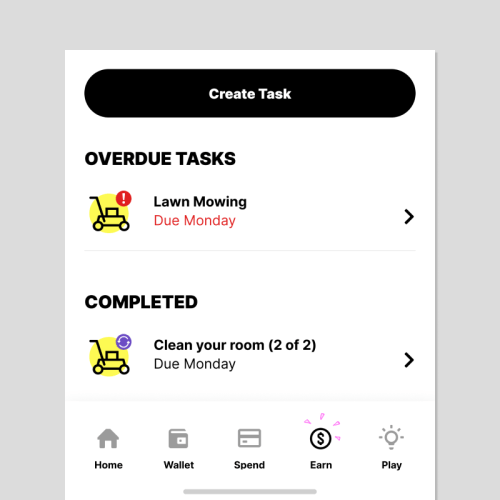

The Mydoh app also lets you easily create tasks for your child, track if they’re overdue and know when they’ve been completed.

Here’s how the Mydoh allowance tracker works:

Choose a task to assign to your child

Help your kids be more responsible and earn some cash by doing chores around the house. Select a task from the app or create your own.

Tip: Keep track of upcoming chores on your fridge with our free downloadable chore charts.

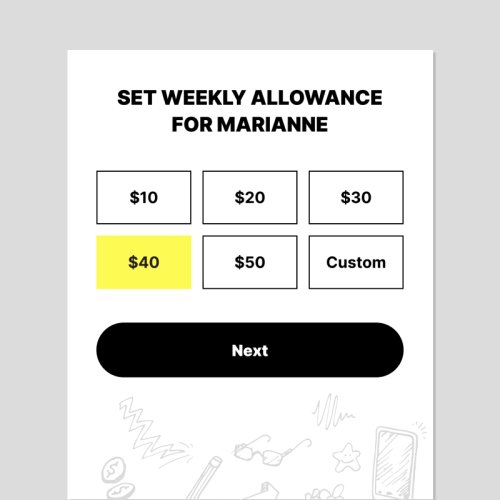

Set a weekly allowance

Create a weekly allowance for your kid’s everyday expenses. This allowance will be paid out every week on Saturday (Pay Day!).

Tip: If you need help figuring out how much allowance to give, use our kids allowance calculator.

Learn more about how to use Mydoh to track chores.

Success with money and in life starts at home

Many parents are looking for money making ideas for kids. Many times it’s the little things such as routine chores that can be the answer. And doing chores can help establish a routine and lead to long-term success.

Mydoh will continue to be here, helping teach kids about money and keeping them busy in those off-school hours. Sign up for Mydoh and begin teaching your kids about financial literacy today.

Download Mydoh today to learn more.

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or its affiliates.