For parents, the teen years are all about trying to stay connected to their kids and helping them manage the emotional ups and downs that come with young adulthood. But this is also the best time to start laying the groundwork for financial independence by teaching teens budgeting tips, like how to make a monthly budget.

Even if your teen hasn’t been learning the basics of saving and spending since they were wee, developing healthy money habits is possible—with a little practice. Teaching kids how to budget can start around the age of 13 or when they begin earning more money through kids allowances, teen summer jobs, or part-time jobs during high school.

In this guide, we’ll cover what to put in a budget, how to explain needs versus wants, and easy tips for budgeting for teens.

Key takeaways

- Budgeting is the process of creating a plan for how you are going to spend the money you have coming over a set period of time.

- Budgeting is important in helping tweens and teens to learn how to manage their money and become independent.

- The four key components of a budget are: income, expenses, savings, and debt.

- Parents can help their kids create a budget by deciding on their needs, wants, and savings goals.

What is budgeting?

Having a budget means tracking the money that comes in (via income or allowance) and the money that goes out (for things like bills, groceries, and entertainment). When you create a budget, you’re making a plan for how to spend your money. And when you have a plan, you know that you’ll have enough for the things you need to pay for (like your monthly rent), a little extra for unexpected costs (like those gym shoes that went missing), and hopefully some leftover funds to pay for the things you want (like an occasional dinner out with your besties).

You don’t have to be a financial advisor to teach your teen why budgeting is important—keep these kinds of discussions on the lighter side.

Teens should think about a budget like a see-saw with one person sitting on each end. With a budget, they have to balance the weight of money coming in (income) and the weight of money going out (expenses). If they’re always spending more than they’re making, one of the people is going to lose their balance and fall off.

Why is budgeting important?

Ideally, teens should learn about budgeting and acquire real money skills well before they move out and have rent payments and other monthly expenses to worry about. This is especially true now, when Gen Z and Millennials are increasingly going into debt just to cover day-to-day living costs. What’s more, a 2019 poll by the Royal Bank of Canada found that many Canadian parents are financially supporting their kids well into adulthood, with 48 per cent still helping their 30- to 35-year-old children. While many of the parents surveyed were happy to help out with post-secondary education and living expenses, longer-term, it was having an impact on their own ability to save and plan for retirement.

4 key components of budgeting

Before talking to your teen about how to save money, break down the four basic components of how to make a monthly budget: income, expenses, savings, and debt. Having a handle on these areas will allow your teen to see where their money is going and help them make smarter choices about how to spend it in the future.

1. Income

The first step in creating a budget is knowing how much money you have coming in. Does your teen have an income from a part-time job, babysitting, or an allowance for doing daily chores around the house? Have them list all sources of income and total the monthly amount. If the income changes from month to month, they should stay on the safe side and stick with a lower amount so they don’t overestimate.

2. Expenses

Expenses usually fall into two main budget categories: “fixed expenses,” which should stay the same month to month, and “variable expenses,” which go up and down.

Fixed expenses are things like car-lease payments, car insurance, a cellphone plan, a gym membership, media subscriptions, and rent.

Variable expenses can include things like groceries, restaurant meals, entertainment, travel and gas. These are the ones your teen has much more control over, and they can easily make or break a budget.

3. Savings and investments

If your kid is old enough to start making money, they’re also ready to learn about investing and the importance of saving money at a young age. Talk to your teen about how much money they should have left over to save each month and how they can earn money on those savings with different types of investments, such as youth savings accounts, Tax-Free Savings Accounts (TFSAs), Registered Retirement Savings Plans (RRSPs) and Registered Education Savings Plans (RESPs). Help them set a monthly goal for saving, which can always be adjusted once they start tracking their monthly budget and putting it into practice. Our kids savings calculator is a great free tool you can use to start setting these goals and tracking their progress.

4. Debt

Like riding a bike, cooking, and doing laundry, making a budget is an important life skill for teens to master. That includes learning about credit and debt. If your older teen wants to apply for a credit card or take out a student loan, this category should be earmarked for paying down debt, which can add up fast.

Teach your teen about needs versus wants

Even adults sometimes have a hard time telling the difference between a need and a want, so it’s important to learn to differentiate between the two at a young age.

At first thought, it seems pretty basic. Needs are the things we need to survive: food, shelter, clothing, personal-care items, and, in most cases, safe, reliable transportation. Just about everything else can be classified as a want—a bigger wardrobe, treats, gadgets, movies, trips, a fancy phone, a new bike. The list is endless.

But even within the needs category, there are many grey areas. We have to eat every day, but we don’t need takeout or $5 lattes. We need clothes, but we don’t need the latest on-trend sneakers to get by. Help your teen take stock of everything they have; chances are they already have more than they really need. Encourage them to practise daily gratitude and to appreciate experiences and relationships over material things. Soon enough, differentiating between needs versus wants will likely become second nature.

5 steps to help your teen start budgeting

Once you’ve covered the basics with your teen, it’s time to dive in and show them how to start a budget. You can always adjust it, shuffle the numbers, or reprioritize. That’s what budgeting is all about.

1. Calculate income

If your teen has a part-time job and gets a paycheque, help them decode it by explaining deductions for taxes, pensions, and employment insurance as well as the difference between “gross” and “net” income. (The latter is what they take home—think of fish caught in a net.) If taxes are taken off their earnings, tell them not to fret—they may be eligible for a nice refund come tax season. Next, add other pieces of income not subject to tax, such as tips, gifts, or allowances. If the amount changes month to month, create an average by adding up income received over the past few months and then dividing that total by the number of months.

2. Identifying fixed and variable costs

When you’re teaching your teen how to categorize expenses, help them break them down into fixed costs (like car payments, gym membership, and media subscriptions) and variable costs (like gas, outside food, and entertainment). The next step is discussing and identifying which fixed and variable expenses are needs versus wants. For each item on the list, you can ask them: “Is this something you can live without?” For example, they might need gas to get to work, but is another streaming app a necessity?

3. Setting up savings goals

In addition to setting aside money for different expenses, your teen should also be thinking about how much of their income should go into savings each month. Savings can then be further broken down into short-term goals (like saving up for a new video game or a virtual-reality headset) and long-term goals, where the money would go into an investment account like a GIC (Guaranteed Investment Certificate) or mutual fund. Take some time to research options for investing for beginners.

4. Discuss how much of their income should go to needs, wants, and savings

Now that your teen has set some money goals, take another look at all their expenses, including needs, wants, and savings, and discuss how much of their income should go where. One common budgeting strategy is the “pay yourself first” method, which means you immediately put a certain amount of your income into savings, pay your bills, and then everything left over can be spent however you like. Another popular model is the 50/30/20 rule: 50 per cent for needs, 30 per cent for wants, and 20 per cent for savings. These percentages can always be tweaked. For example, if they don’t have many expenses, encourage them to contribute a larger chunk toward savings. Conversely, if they don’t make a lot of money, even a small percentage put into savings is a step in the right direction.

5. Decide on budget categories

Still not exactly sure what to put in a budget? This is where you can get into the nitty-gritty of categorizing all expenses and deciding roughly what percentage of the income will go toward each category. A teen budget may include categories such as savings, clothing, gas money, eating out, cellphone bill, school supplies, or activities that you (the parent) don’t pay for. Your teen can be specific and list as many categories as they want, or keep it simple—however it needs to look so they stick to it.

3 tools that kids and teens can use for budgeting

Keeping track of monthly income and expenses is pretty easy if you’re using a consistent method or tool, whether it’s a paper notebook, online spreadsheet, or budgeting app.

1. A basic notebook

It’s the simplest (and oldest) technique for tracking a budget. Using a notebook app (or an actual pen and paper!), write down all sources of income and all expenses. If they balance out, you’re golden.

2. Budgeting apps

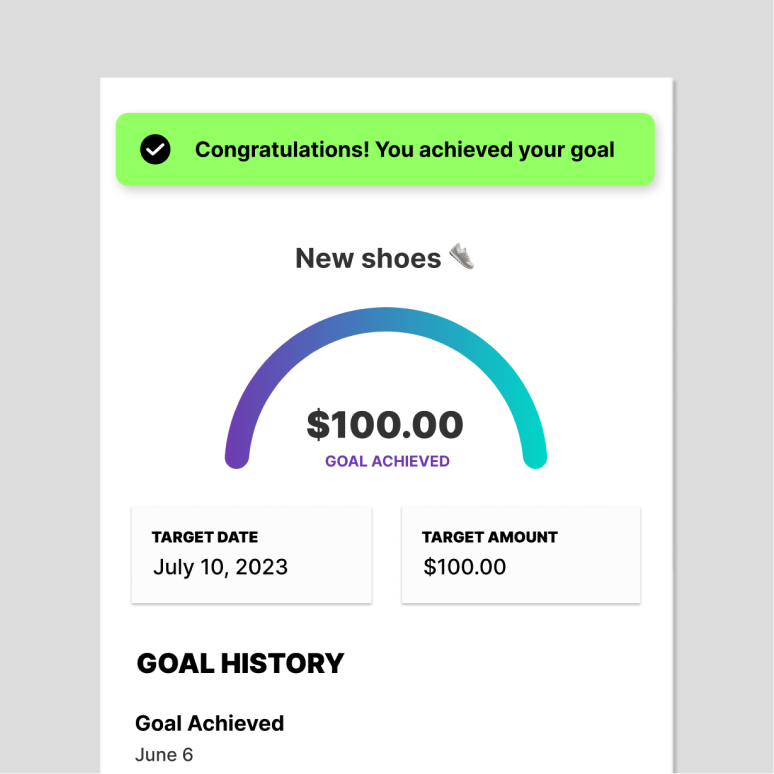

For tech-savvy teens, budgeting apps may be more fun and engaging. They often come loaded with features and budgeting tips to help customize personal needs and goals. Some are even free. There are also apps that help you track expenses to give you an extra level of insight into your spending habits. Mydoh, for example, has a savings goal app to help kids budget and set realistic goals for things they’ve had their eyes on.

New to Mydoh? Mydoh is a digital wallet and Smart Cash Card for kids and teens. Kids can use it to earn money through tasks and make purchases in-store or online. Parents can monitor spending and activities. Mydoh teaches kids responsible money management and smart financial decisions. Download Mydoh and start your free trial.

3. Free budget templates

Budget spreadsheets hit the sweet spot between old-school and high-tech tracking. They contain budget examples and colourful charts, as well as those helpful budgeting tips on how to save in each category. Two of our favourite free and simple budgeting templates can be found on Google Sheets. Just go to google.com/sheets, browse the template gallery and pick the “Annual budget” or “Monthly budget” templates.

If you’re looking for other online finance tools to use as a family, you can also check out Mydoh’s free financial literacy tools for kids.

How to check on your teen’s budgeting

Now that your teen understands how to budget, keep that money conversation going—without nagging. Some experts suggest having a monthly family money meeting and empowering kids by asking them to weigh in on how to spend family money on things like vacations, new vehicles, or charity. Then move on to your teen’s personal budget.

Your monthly meeting can be an opportunity to share your own financial stories and be real about struggles you had or mistakes you made when you were their age. Did you max out a high-interest credit card or blow your first paycheque on a pair of expensive jeans? It helps them to see that no one is perfect.

These check-ins aren’t meant to be overbearing; they’re designed to help teens develop financial self-sufficiency. Review the goals they met (or didn’t meet), and help them identify future things to strive for. Maybe they want to save money to live on campus during university or buy their first car. Set them up with a Mydoh app and Smart Cash Card to help them gain real money skills. Maybe you want to offer your own incentives by matching the money they’re able to set aside for big-ticket items. If it’s post-secondary education they’re interested in, you can brainstorm scholarships or grant money they may be eligible for and help them apply.

Set your teen up for success

Once you’ve covered the basics of budgeting, including what budgets are, why budgeting is important, and what budgeting apps and tools are out there to help them stick to it, your teen should be more equipped to take care of themself down the line. As they start earning more money of their own, discuss having them take responsibility for some of their bigger needs and wants, whether it’s buying their first car, going on a trip, or even moving out of the family home. You’ll be helping them gain confidence in knowing that they can one day be financially independent—and you’ll be able to breathe a sigh of relief knowing that they’re on the right track.

Download Mydoh to make it easy for your teen to start earning cash, saving and budgeting.

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or its affiliates.