Schools teach kids some pretty impressive skills that surpass those of most of us adults—labelling a cell’s mitochondria and conjugating French verbs come to mind—but teens and tweens often lack an education they desperately need: financial literacy and basic money-management skills, like how to budget. For the record, some parents aren’t too sure how to create a personal budget, either—sigh.

At the end of the day, it’s up to us parents to teach our kids why budgeting is important before they go out into the real world. Like other skills, getting good with money and learning about budgets and expenses take practice, and practice takes time. The earlier they start to work on it, the better, but it’s also never too late to learn how to budget money.

So whether you’re teaching a preschooler how to budget by encouraging them to plop a quarter in a piggy bank, or assuring your teenager—yet again—that an Xbox is a want and not a need, the basics of creating a budget (and then managing it) remain largely the same.

Read on to learn why budgeting is important and how to start a budget, and discover some cool tools that can make budgeting for teens easier.

Key takeaways

- A budget helps teens and kids plan for how they want to spend their money.

- Help kids create a budget by calculating their income and identifying any regular costs.

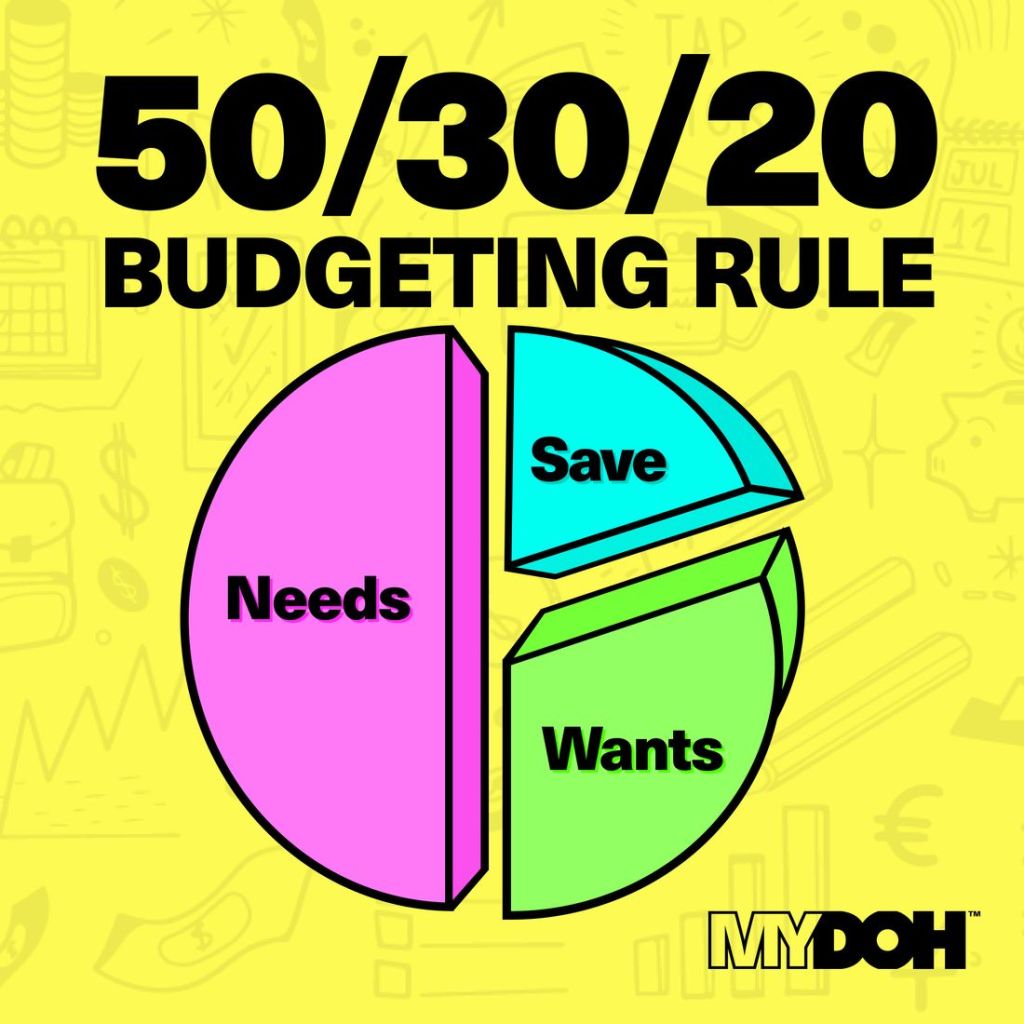

- Use the 50/30/20 rule to create a budget.

- Help kids and teens make use of online budgeting tools or a spreadsheet to manage their spending and savings goals.

Why is it important to create a budget as a teenager?

There’s temptation for your teen to spend money around every corner—a fancy coffee with friends here, a trendy new shirt there, and yet another meal out for a pal’s birthday celebration. Then, before they know it, they’ve blown all their dough and can’t afford that data plan they’ve been trying to save for. But having a budget in place will give them a plan for how to spend and save their money. And teaching kids and teens to budget will help them gain money-management skills that will serve them well into adulthood. The biggest benefit of having a personal budget is that if they plan correctly, they’ll always have money for the things they need, and hopefully some left over to buy the things they want.

And while you might not rope a young child into sitting through creating a budget for your household expenses, it’s still crucial for them to learn how much things cost (say, a coveted toy), and if they have enough money to pay for it. (Will their allowance cover it?) As kids get older, they can save up for something bigger—like a new gaming station—and figure out how to save money for it.

By learning how to budget at a young age, kids will grow into teens, and then adults, who understand how to save money and have control over their personal finances.

5 steps to create a budget for kids

1. Calculate their “income” (a.k.a. allowance)

Imagine you wanted to learn to play basketball, but had no ball to bounce and no hoop to shoot into. This is what learning about money is like when you don’t have any money: purely theoretical and not particularly helpful. If you want your kids or teenagers to learn how to budget money, one way to start is to give them some cash to practise with.

No matter how old your kiddo is, giving your kids an allowance is a good strategy to provide them with a regular “income.” Some experts say the child’s age should equal the dollars per week, but crunch the numbers using our allowance calculator and figure out what works best for your family.

The point is that money needs to come in before it goes out, and your child needs a fixed dollar amount they can build their budget around.

2. Identify their fixed and variable costs

“What normal kid has fixed and variable expenses,” you ask? While your tween or teen isn’t paying off a mortgage, they’ll likely have fixed and variable costs they need to cover. Things like extracurricular activities, a monthly cellphone payment, or buying lunch at the mall a couple of times a week can function fantastically as ways to differentiate fixed from variable expenses.

In the shortest and simplest of terms, you want kids to understand that a fixed cost is a particular amount of money for a specific good or service where you know the amount and date due in advance. Planning for this in their budget now helps prepare teens for the inevitable day when they’re paying fixed expenses to live on their own or insure their car.

Then teach your kid the wonderful later-in-life gift of living out of the red. Show them how planning in advance and paying bills on time without incurring late fees will help them know what’s left over in the budget for variable expenses.

3. Discuss the difference between needs and wants

It sure is nice to be a kid. In their world, paying for “variable” expenses and spending money often mean the same thing. (Don’t begrudge them this luxury; they’ll be paying electricity bills and household maintenance fees soon enough.)

Where kids of all ages don’t have it so easy, however, is distinguishing the difference between needs and wants. While you’ve probably had practice recognizing the familiar feeling of not needing another black dress, children and teenagers aren’t always great at restraint. (Remember when all your friends had the same new, cool shoes, and if you didn’t have the same pair, your life would be over? Fast-forward a couple of decades, and nothing much has changed.)

High school can be tricky. To some kids, those new shoes are a need, of sorts. That’s OK. The trick here is teaching and understanding value alongside cost, and if your tween fashionista really needs those shoes, they’re going to have to save and budget for them.

If that sounds like too much work (and your kid promptly forgets what was so great about those shoes to begin with), maybe it was just a fleeting want after all. Either way, there’s a good lesson to be had.

4. Have your child set up savings goals (or the 50/30/20 rule)

OK, let’s say your kid is gung-ho for the shoes and willing to work for them. This is a built-in “goal,” not to mention a great opportunity for you to teach about short- and long-term savings. The shoes are short-term, but what about long-term? Don’t hesitate to remind your teenager how awesome they’d feel buying their first car, paying for a year of university tuition up front by themselves, or actually taking that gap year trip to Europe.

The ultimate goal of money management is to find that sweet spot between today, tomorrow, and the future—it’s something even the savviest money mavens have to balance all the time. The parents’ version of this tends to be today, the end of the month, and retirement, while a teenager’s is more like today, the weekend, and summer vacation.

The point is that everyone allocates time, effort, and resources in much the same way. Experts call this the 50/30/20 budgeting rule, and it’s a great model for teaching your kids. They’ll learn how much money is OK to spend, and that it’s equally fine (and important) to enjoy pleasure and entertainment in this life. But it’s also very wise to pop a few dollars away regularly to invest in your future self. If and when you can do all three at once, spending money won’t feel stressful or wasteful, but easy and productive.

5. Decide on budget categories and the percentage of income that will go into each

Congrats! You and your money-wise kid have come to the end of this lesson and the start of your real-life budgeting adventure. Now’s the time to divide that allowance or income into categories, with a percentage of the total allotted to each.

It’s a really good, you’ll-thank-me-later habit to immediately put 20 per cent of your income aside as savings. Little ones do very well with a jar, rather than a conventional piggy bank, so they can see the coins continually mounting. (Just carefully cut a slit in the lid and don’t forget to close it tight.) Teenagers are more likely to be impressed by dumping that 20 per cent right into an online savings account, where they can watch interest accumulate. Free money!

Provided your kid completes their part of the bargain and saves just a bit, take a step back and let them make a list of budget categories that matter to them, such as clothing, toys, entertainment, snacks, trendy shoes, and even an Xbox. Don’t forget about big events like budgeting for holidays or budgeting for prom! What matters to them is almost certainly not what matters to you, but that’s not the point. You’re teaching them that their needs and wants cost money, money has value that needs to be earned, and nobody gets everything they want whenever they want it, so choose wisely.

Now that’s a money-management lesson that can’t be bought. Good job, you.

Tip: Mydoh’s savings goal calculator does the math for you! Enter your earnings, what you spend, and see how much is left to save for the things on your wish list.

How to teach your kids to track their personal expenses and monthly budget

Now that you have some strategies in your back pocket that will help you and your child create a budget, you’ll need to figure out how to manage it. Here are some ideas for maintaining a personal budget:

Use budgeting tools to make tracking easier

Here are some of the best budgeting tools for kids:

Budget planners: Don’t underestimate the ease and satisfaction of an old-fashioned notebook that fits into a purse or backpack. Let your kid choose a design they love and a fancy pen (and colourful stickers) to help them track their budget and expenses.

Budgeting apps: We would be remiss not to mention the Mydoh money app for kids and teens, of course. But there’s no shortage of budgeting apps for teens to help kids track their spending and savings. Best of all, many are free.

Budget worksheets: A quick Google search for “budgeting templates for kids” will give you a ton of colourful downloadable spreadsheets that your kid can use on a computer or smartphone. Tech-savvy kids will have no trouble keeping track of their cash with one of these.

Create savings goals and make it fun

Savings goals to look forward to: Those swanky sneakers will feel doubly sweet to your kid if they’ve earned them. Amp up the hype with a large savings jar they can watch fill up, a savings goal calculator or an automated savings goal app. A growth chart on the wall is a fun visual, too: Colour in every dollar saved and watch the stack get taller and taller.

Set a challenge with parents and siblings: Even better? Make two charts, hang them side by side, and make saving an exciting race. Each family member has their own savings goal, but the first person to the top wins!

And, parents, don’t forget that your kids are always watching, listening, and, ultimately, internalizing how you feel and act around money. If you blow every dollar on more stuff, they are more likely to think saving sucks. If you’re anxious and stressed out about money, they may conclude that budgeting’s a chore. But if you let them watch you controlling your cash, saving when you should (and can), and splurging when you’ve earned it, you’re more likely to instil good money habits for the long haul.

Show your kids how to budget and spend responsibly toay!

Now that you know a bit more about how to budget, and why budgeting for teens is important, you can help your kids and teens create a personal budget. All these budgeting tips can help them grow into young adults who take control of their personal finances.

Another way you can help kids understand the world of money management is by using the Mydoh money management app and the Smart Cash Card. Kids can earn their own money through tasks and chores, then spend it with their very own card. Parents can check in on how their kids are doing and gently guide them on their way toward financial independence.

Download the Mydoh app today to get started teaching your kids how to budget responsibly and have peace of mind with its digital wallet and Smart Cash Card for teens!

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or its affiliates.